How To Deal With A Very Bad Garage Financing

Dealing with a very bad garage financing situation can be stressful, but there are steps you can take to navigate the situation effectively:

Assess Your Situation:

- Understand the terms of your financing agreement, including interest rates, payment schedules, and any penalties for missed payments.

- Determine how much you owe and what your current financial situation looks like.

Communicate with Your Lender:

- Reach out to your lender to discuss your situation. They may offer options such as deferment, restructuring your loan, or other assistance programs.

- Be honest about your financial difficulties; lenders may be more willing to work with you if they understand your situation.

Explore Refinancing Options:

- Look into refinancing your garage financing. This could involve taking out a new loan with better terms to pay off the original financing.

- Compare rates and terms from different lenders to find the best deal.

Consider Selling or Downsizing:

- If the financial burden is too high, consider selling the garage or downsizing to a more affordable option.

- Evaluate the potential equity in your garage and how much you could gain from a sale.

Look for Financial Counseling:

- Seek advice from a financial counselor or advisor who can help you develop a budget and create a plan to manage your debts.

- Non-profit credit counseling agencies can provide resources and support.

Explore Government Programs:

- Research any government programs or grants available for home improvement or financing that might assist you.

- Local or state programs may offer assistance for home repairs or improvements.

Make a Budget:

- Create a detailed budget that accounts for all your income and expenses. Identify areas where you can cut costs to help manage your payments.

- Allocate any extra funds towards your garage financing.

Stay Informed:

- Keep up to date on any changes in the financing industry or new programs that may help you manage your situation better.

Legal Consultation:

- If you feel overwhelmed or believe you’re being treated unfairly, consult with a lawyer who specializes in consumer finance or debt relief.

Stay Positive:

- It’s important to stay positive and focused on finding a solution. Financial difficulties are common, and with the right approach, you can overcome them.

all the things you must know before financing

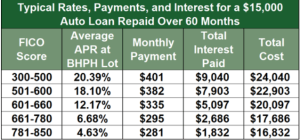

different credit scores loan rates

different credit scores loan rates

If the proof of income you provide does not match the amount of income you stated, they can choose to not fund the loan.

Lenders may request supporting documents such as proof of income or employment.

They only held on to 1 percent of their income in 2005, which is well below the 12 percent personal savings rate they achieved in the 1980s.

The financial crisis of 2008, however, was a shock that made many people aware of the need to build a cash cushion.

bad credit or good credit ?

The highest quality bad credit lenders will offer you a good affordable rate as well as tools to build your credit, quick funding, and a mobile app to help you remember and manage your loan payments.

zero present financing avalible now

zero present financing avalible now

Can you finance a garage with a 600 credit score?

You probably can but the interest rate will be higher.

we at garage door Indianapolis offering great financing with NO CREDIT NEEDED !!!

garage sizes that you can finance

This has lead to the availability of new or used truck finance in Melbourne to get your fleet off the garage.

What is the best way to finance a garage?

If a 24×24-foot garage pushes your budget, you may want to consider a slightly smaller garage that can still fit 2 cars.

In addition to feces, running the bowels can reveal polyps, tumors and other things of great value to pathologists.

Their economical value makes it easier to get funding for construction.

Adding electricity or plumbing may be easier for an attached garage.

However, detached garages may provide more flexibility and are usually easier to expand down the road.

you must get prequalify ?

Detached garages usually have more construction costs since they are standalone buildings.

Since you will be building a standalone building you may need a new power source.

Now, prequalify.

Prequalifying will give you more estimated information on if you would be approved, what your rates would be, how much money you could take out, and what your term length would be.

For example, if you use a $35,000 personal loan with a 7 year term at 4.99% you could have a monthly payment as low as $495.

can u finance a detached garage door ?

You can use garage financing for building detached and attached garages.

Earlier we mentioned the importance of making sure that your garage addition “fits in.” If you build a detached garage you should focus on matching the architecture to your home.

Architecture costs should be accounted for whether you are building an attached or detached garage.

In addition to basic building costs such as:

- walls

- doors

- foundation

- etc.

you should consider expenses such as electricity, plumbing, and architecture for a detached garage.

how you pay for detached garage door ?

The kits usually cost between $30,000-$40,000 not including installation, permits, or other building expenses.

Typical operating costs include staffing, which can account for 50 to 70 percent of overall expenses.

On average garage door installation costs between $500-$2,000.

Yes, garage doors and installation can be financed.

Steel garage doors are an inexpensive and popular option.

In addition to detached or attached, there are a variety of other choices that can affect the cost of building a garage.

Can you finance a garage with bad credit?

The downside is it can be hard to customize steel garage doors and style choices can be limited.

FHA loans are designed to help borrowers finance homes with less than perfect credit or limited down payments.

A FICO score of 600 is considered to be fair credit.

You can still finance a garage door with bad credit using our payment options

This will boost your credit score.

If you have bad credit you may be able to finance a home addition such as a garage.

Your bank or credit union can discuss loan options to help you set a realistic price range that fits your means and budget.

That should help you get lower rates on your loan because the other person’s creditworthiness is taken into consideration.

should you use garage door financing ?

Paying for a new garage door out of pocket can be a pretty significant cost, but to help ensure that you’re doing everything right for your home, your family, and your lifestyle, we offer several financing options to ensure that you’re making the right decision at the right time.

Timing also plays a pivotal role toward the end of financial year as this is the time where most lenders offer the best deals to hook new applicants for the upcoming business year. In most cases when you prequalify for a loan, the offer will be contingent upon a few things.

To qualify, you will need a decent amount of equity in your home.

the advantage of personal loan ?

Most lenders offer fixed terms for personal loans so your monthly payment will be consistent.

The benefit to a personal loan is that it usually does not require collateral or a down payment.

For your convenience, we accept a number of payment options and we also offer flexible financing with Greensky Financing, based upon credit approval.