10 Issues I'd Do If I would Start Once more Garage Financing

all the thing u need to know before finance

You can work with Garage Living to submit an application electronically.

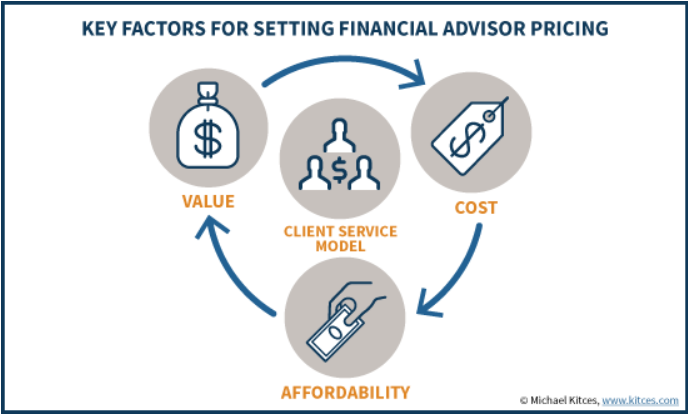

You can consider taking the help of a professional financial advisor to evaluate your preferred financing option & make sure there’s no blindspots that has been overlooked. Consult with your financial advisor into choosing a plan that will help you finance this new rig without constraining your budget.

For example, if you pay only the minimum on your credit card, it will take you years to pay off what you owe.

Truck usage is witnessing a mushrooming growth for the last couple of years. Sklavounakis said the city can make this investment, collaborate with the private developer now and help spark downtown economic growth – or just do nothing and potentially watch the Wheeling-Pittsburgh Steel building sit vacant for another decade or more.

“This is a project that people have strong opinions on,” Mayor Glenn Elliott said, describing the Wheeling-Pitt building as basically the only skyscraper in town and a structure that was “gifted” from prior generations to serve as an important anchor to the downtown.

how to get you garage door finance ?

Now that the bond ordinance has been approved, the parking garage project will proceed to its next steps, including demolition of the vacant Chase Bank Building at the site, securing of funding through a local lender and awarding of bids to a contractor to construct the new structure.

Initial plans for the new parking structure started out at around $13 million, Chaplin stated, noting that more recent estimates being provided by the city have escalated by millions.

The proposed six-story parking structure is expected to be built on the corner of Market and 11th streets to provide needed parking for tenants of the Historic Wheeling-Pitt Lofts, a nearby landmark being renovated into apartment buildings by a private developer.

These future steel buildings provide storage solutions that can withstand extreme weather conditions.

Choosing the right plan with your garage door payments can really make all the difference.

Remember; timing your finance is crucial to impact a significant difference in sealing the best deal.

Garage Door Services: Chat with a Specialist

how to get the best interest rates ?

Then, proceed to our online finance application.

We also offer an application only program up to $250K to save you time and flexible pay structures like 90-day deferred payments, seasonal payments (and more) that closely match the revenue generated by your new equipment.

Fill out our quick from to schedule a time to speak to a member of our equipment financing team.

Our auto garage equipment financing specialist is standing by to help you get financed.

No, you typically cannot get full auto insurance coverage on a vehicle with a salvage title. Regardless of where you are buying your auto garage, auto repair or body shop equipment, we can provide fast, cost effective financing with rates as low as 4.5% to get you on the road to making money.

The Wells Fargo Home Projects Credit Card Program is designed for financing home improvement projects, and helps you start your garage door project immediately without paying the full cost up front.

Financing for GreenSky® consumer credit program is provided by equal opportunity lender banks. With a standard SBA-backed loan (7(a) Loan Guaranty Program), you can borrow up to $2 million;

however, the SBA will only guarantee the first $1 million.

Our partnered lenders will help go over your proposed budget, and analyze the costs and interest, to come up with the right monthly payment that works well for you and your household.

what u need to know before financing garage door?

We’ll help you choose the right type and style of garage door for your home, we’ll help install it, and we’ll even help you finance it.

You’ll also need to consider garage door components:

- like the opener

- the pulley system

- the track and rails

- and even the sensors.

Of course, the style is a big decision, but you’ll also want to think about factors like R-Value, which is the measure of thermal resistance with your garage door, which can help keep the cold winter out and the warm house heating in.

At Precision Garage Door, we’re committed to providing reliable garage door services that are professional and affordable.

Precision Overhead Garage Door of Polk County now offers financing options for garage door repair or brand-new garage door installation.

In fact, if you can check with your insurance agent, you might discover that the insurance companies give you a break on your premiums when you install an overhead garage door.

In addition, lenders may advise against 203k rehab loans because it takes more time and effort for them to get borrowers approved.

For personal loans, most lenders will want a credit score between 610-640.

Some lenders may be willing to work with borrowers that have a credit score lower than this, so don’t be completely discouraged. “I also have concerns about the costs,” Councilman Ben Seidler added.

We have same-as-cash loan programs; which give you 12 to 18 months with no payments and no interest.

The type of loan you are applying for will also impact the credit score requirement.

As you sort through lenders and their requirements, it’s important to keep in mind that just because you meet a credit score requirement does not mean you will qualify.

If it’s been a while since you have had any missed payments, they may be more willing to extend you a loan.

It’s run through the e-financing platform and allows you to apply for financing anywhere, anytime, and on any compatible device in less than 10 minutes.

Using cash allows for budgeting a fixed amount in real currency, while buying with a debit card pulls monies directly out of your bank account up to the limit of your balance.

Five Stylish Ideas For Your Garage Financing

While you may be fearful of a credit check, a no credit check loan can be costly. While most lenders work with the FHA many of them do not offer 203k rehab loans.

The term lengths of personal loans usually are between a year and 60 months, but some may be longer.

There are other things to think about besides just the term length. Insurance costs for liability are also a function of how much valet there will be.

Take into consideration total loan costs before committing.

Ultimately though, you should not always accept a loan just because you qualify. Getting a 203k can be complicated compared to getting a personal loan.

Utilities can account for 10 to 15 percent of expenses.

Typical operating costs include staffing, which can account for 50 to 70 percent of overall expenses.

Lenders can also approve unsecured lines of credit for up to $25,000 under this program. If you already have a garage on-site the 203k loan program considers building another garage a luxury item.

If you do not have a garage and want to build one with an in-law unit on top, the garage must share a wall with the existing structure to be qualified for the 203k program. However, in the long run you will have a higher interest rate cost. “In government, the cost is always more than the estimate. WHAT’S IT COST TO RUN YOUR GARAGE? A hotel garage with valet parking will spend more than an office building garage with self-parking by monthly cardholders. Garages with transient clients will require more cleaning than those with monthly users because there are more vehicles coming in and out. Steel Building Garages has sold steel buildings for over thirty years, and metal pole barn packages are one of our signature products. If you’re installing walls, mount girts all around the building at ground level, making sure they’re level. For more tips on building up your savings, check out the links on the next page. Initial plans for the new parking structure started out at around $13 million, Chaplin stated, noting that more recent estimates being provided by the city have escalated by millions.

All kinds of garagedoors have balancers that enable them stay partially opened without falling down. They’re built to last, provide good value and can be dressed up or down as desired. If you can improve your credit before taking out a loan, it may save you a lot of money. You could also get an auto title loan, which uses your car as collateral.

On the other hand, a car that receives a salvage title because its frame was bent in a crash could be a nightmare to repair and may never be safe to drive.

Should you ever buy a flood-damaged car? Once you consider the service, cost, and quality, hopefully you will find the right company from which to buy your garage door.

By having the right equipment, your business can significantly increase its productivity and sales. Q. Why should I finance my project when I can pay cash or use a credit card? The project has been scaled-back from its original proposal; however, the process, analysis and anticipated benefits have been documented to guide others considering similar projects.

At this point the best choice is always to open some pot credit card, having a small limit (an amount you can pay for to settle in case your adolescent will be irresponsible) as well as train your teen they can just use the quantity around the credit card they can afford to cover entirely at the end of the month.

The amount you’re eligible for is based on your home’s future value after renovations and is ideal if you have less than perfect credit.

It can have a transformative effect on your home’s curb appeal and resale value. Also, not only can a garage door of higher quality last longer, but it can also help boost your home’s resale value. Your new garage door is ready and waiting for you.

Don’t just throw a new garage door on a credit card in a pinch when you might be able to find financing for a garage door at much better terms.

For one $10 million investment, the fund might receive back $50 million over a five-year period.

A VC firm might typically receive anywhere from 10% to 50% of the company in return for its investment.

Financing allows you to spread payments out over a longer term so you build up more cash in reserve – or deploy your cash in an investment that’s going to pay out more than the garage door financing’s interest rate.

If you’re having an emergency, if you’d like to keep your cash for flexibility or if you believe in the value that a garage door is going to deliver, we can discuss financing options.

If you can find favorable financing terms, making an investment in the more expensive garage door is going to pay off in the long run.

I recommend joining a local freecycle and going garage saleing, and to thrift stores to find stuff for your baby 2 be!

Specials: Here’s where garage door financing gets really good: when you find a company or manufacturer running a special.

Synchrony Bank can offer you a budget-friendly way to help you complete your repair or new door installation.

Precision Overhead Garage Door of Spring Hill, FL now offers financing options for garage door repair or brand-new garage door installation. Since 1955, Broten Garage Door Sales has been providing expert installation, repair and maintenance for garage doors, openers and accessories.

Don’t let a lack of financing stand in your way – we’re here to help at Broten Garage Door Sales. If your garage door completely collapses and there’s simply nothing to be done other than a full replacement, that’s an emergency.

Get the garage door you want now and pay over time. Interested in getting more information on financing for your garage door? At Broten Garage Door Sales, we provide new garage doors to homeowners in Broward County, Palm Beach County and throughout South Florida. A new garage can be financed starting from just $59/bi-weekly, on approved credit. If the current garage is a safety problem, replacing it can be done with this type of financing. Broten often runs specials that offer money-off on one- and two-car garage doors, free accessories and more! With promotional financing from Discount Garage Doors, major purchases don’t have to wait.

Can you finance a garage with bad credit?

Even adding a garage onto your property can fall under FHA 203k financing in the right scenarios. Average buyers put down about five percent of the purchase price, but that doesn’t cover even the sales tax and other fees.

There is no worry about choosing a paint color or what type of paint to purchase because it is not necessary for this material.

It is a costly project that can be complex, but you can make the process seamless by creating a budget for the renovation, choosing the right funding option, and developing a realistic plan of action to move forward. You also must have like-properties to comare your project to, ensuring that the improvements will add the right value within the neighborhood. Remember, that outbuildings are not allowed to be part of a 203k renovation project. The FHA 203k is such a versatile renovation loan, it’s sometimes hard to say what home improvements are eligible for financing because so many projects are covered. Whether they would likely be approved or not approved for an FHA 203k renovation loan. Since this mortgage option is an FHA product, it must meet FHA health and safety standards.